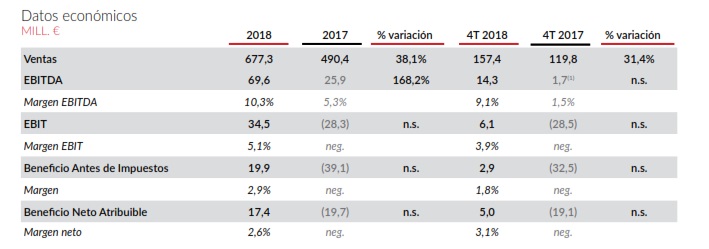

TUBACEX closes 2018 with an EBITDA of 69.6 million euros, the highest in the last decade

- Sales in 2018 amounted to 677.3 million euros, 38.1% more than in the previous year and the profit was EUR 17.4 million.

- Although the market has not yet recovered, TUBACEX's commitment to high-tech products and services, along with the latest strategic alliances signed in Egypt, India and Abu Dhabi, are allowing it to emerge reinforced by the longer oil crisis.

- TUBACEX envisages a strong expansion for the 2020 and 2021 financial years.

Llodio, 28 February 2019. TUBACEX today presented the financial results for the 2018 financial year, where it has recorded an EBITDA of 69.6 million euros, the highest figure since 2008 and which means multiplying by 2.7 the result obtained in the previous year. Sales amounted to 677.3 million euros, 38.1% above 2017, while the profit has been EUR 17.4 million.

TUBACEX has continued to make progress in improving its positioning in key sectors with the signing of three important strategic alliances in high-growth markets. In this regard, it is worth noting the partnership with Tubes 2000 for the development of nuclear energy in Egypt, the agreement signed with the Indian company Midhani to address energy growth in India and the recently announced Joint Venture with Senaat, Abu Dhabi's state investment group, for the development of Oil and Gas projects in the Middle East. It is one of the regions with the largest oil and gas resources, and is currently immersed in a growth plan.

These three alliances, together with TUBACEX's firm commitment to the development of high technological value products and services, are enabling the company to emerge from the longest crisis in the oil sector.

Jesús Esmorís, CEO of TUBACEX, has positively appreciated these results. "We can certainly say that we are leaving the longest crisis in the oil sector with a reinforced structure that will allow us to take advantage of the growth of the coming years," he said. In addition, these results "show our ambition to become the first supplier of tubular solutions in high alloys".

The development of new businesses is a key objective for the TUBACEX Group. This effort allows, according to Esmorís, "to register various patents that we hope to be able to present to the market between 2019 and 2020 and that will continue to drive our growth as a leading supplier of tubular solutions".

Working capital has closed the year at EUR 222.2 million, EUR 29.2 million above the end of 2017, as a result of an increase of almost EUR 60 million in the Group's stock due to two factors: the increase in nickel stocks and the increase in the current product. The first factor is directly related to the purchased and unused nickel corresponding to the OCTG project for Iran, currently on suspension, and which will be allocated to various projects during 2019. With regard to the second factor, the Group initiated the prefabrication of weeds for umbilical tubes during the last quarter of the year with the aim of increasing competitiveness and reducing delivery times. This strategy has allowed TUBACEX to allocate important orders for this tube by the end of 2018. Both factors have an extraordinary effect of more than 30 million euros on working capital, which the company plans to correct throughout 2019.

Net financial debt amounts to EUR 254.5 million, an increase of EUR 1 million compared to the end of 2017. It should be noted that TUBACEX manufactures on demand, given the nature of the products it offers, tailor-made for specific projects. Therefore, net financial debt is closely linked to working capital, which is mostly already sold and with a net value of positive realization. In fact, working capital accounts for 86.6% of the debt and, as discussed above, without the extraordinary effects on the current, net financial debt would have been around EUR 225.0 million.

In addition, the net financial debt ratio on EBITDA continues to fall significantly and stands at 3.7x compared to 9.8x at the end of 2017. The Group hopes to maintain this trend of progressive improvement until it is placed in the strategic objective of 3x.

As for the future prospects, TUBACEX's CEO advances that during 2019, "a significant number of investment projects will see the green light, anticipating strong expansion for the years 2020 and 2021". It also adds that the company is "in the final stages of awarding several unique, multiannual and high added value projects that, together with strategic alliances, allow us to be optimistic about this year's level of order capture, which we hope will be record. This gives us the ability to close the current year with the highest portfolio and visibility in our Company's history."

Main financial figures 2018

TUBACEX by markets

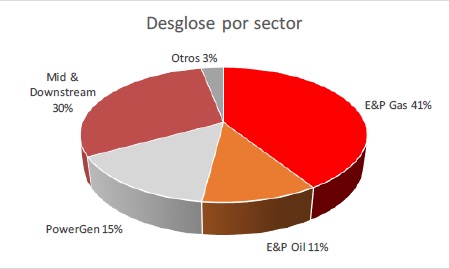

Direct sales to engineering and end customer continue to remain the first entry channel with 73% of turnover, compared to the distribution channel. It is an indicator that reflects the company's success in its approach to end customer with products of high technological value.

The Oil and Gas Extraction and Production sector accounts for 52% of the Group's sales of this channel, of which 41% correspond to Gas and the remaining 11% to Petroleum. This important percentage is mainly due to the high manufacturing volumes of both OCTG and umbilical tubes. The OCTG tube has seen a clear increase in sales in 2018 thanks to iran's project, supplied between March and November and currently on record. However, the company expects order collection to reach important figures with the award of very relevant orders in the Middle East throughout this financial year.

With regard to fossil power generation, it continues to normalize after the 2017 adjustment with China at the forefront, where the TUBACEX Group has participated in several projects. In addition, it is worth noting the improvement of trade positioning in India and South Korea, where significant growth is expected in the coming financial years. TUBACEX has developed new advanced steels that together with Shot Peening technology, to improve their strength, are proving to be the best solution for this demanding market. The company promotes with these developments the sustainability of the energy sector by reducing CO2 emissions.

With regard to the nuclear sector, TUBACEX should highlight the consortium with the Russian company Tubes 2000 to discuss together with the Government of Egypt ways of collaborating to provide products and services for the four units of the El Dabaa nuclear project.

The Mid and Downstream sector has shown a partial recovery in terms of awarding new projects. Specifically, the refinery furnace tube, in which TUBACEX is a market leader, has seen an improvement in 2018 with significant growth in the Chinese market.

About TUBACEX

TUBACEX is a multinational group based in Alava, a leader in the manufacture of tubular products (tubes and fittings) of stainless steel and high alloys. It also offers a wide range of services ranging from custom solution design to installation or maintenance operations.

It has production facilities in Spain, Austria, Italy, the United States, India and Thailand and service centers worldwide, as well as a commercial presence in 38 countries.

The main sectors of demand for tubes manufactured by TUBACEX are oil and gas, petrochemicals, chemistry and energy.

TUBACEX has been listed on the Spanish Stock Exchange since 1970 and is part of the "IBEX SMALL CAPS" index.